Broadcom’s Business Model Supports Robust Dividend Growth

NYSE:VMW) for virtually $61 billion in income and stock. This is 1 of the greatest technological know-how transactions in history and even more blosters Broadcoms application item lineup. This follows several transactions, which include CA Technologies in 2018 and Symantec in 2019, about the earlier number of several years that ended up done to improve the company’s application business.

VMware experienced been switching to extra of a subscription model by itself, one thing that Broadcom has been fairly profitable at executing. The offer, if completed, will signify that recurring software package revenue will contribute practically half of once-a-year revenue. These revenue are significantly extra predictable even if they develop at a little bit lower charges.

The most modern quarterly report coupled with the acquisition of VMware should help Broadcom to go on to expand its dividend at a higher rate.

Dividend analysis

Broadcom has lifted its dividend for 11 consecutive years. Advancement has been incredibly robust as the business has a 5- and 10-yr compound yearly expansion fee of 31.5% and 142%. This transpired even as the share depend practically doubled around the past ten years.

Important for buyers, dividend development seems probably to continue as properly. Broadcom distributed $14.40 of dividends per share in 2021 when producing earnings per share of $28. This equates to a payout ratio of 51%.

The business is projected to distribute dividends per share of $16.40 for 2022, implying an expected payout ratio of 46%. This compares to the 41% payout ratio that Broadcom has averaged due to the fact 2016.

Free hard cash move also demonstrates a identical photo of basic safety. The corporation has paid out out $1.75 billion really worth of dividends about the past 12 months. At the identical time, Broadcom developed free cash circulation of $4.2 billion, resulting in a payout ratio of 42%. This is really shut to the three-12 months regular of 44%.

Turning to personal debt obligations, Broadcom had fascination cost of $1.77 billion around the past yr. The enterprise experienced full credit card debt of $39.2 billion at the finish of the 2nd quarter, resulting in a weighted normal curiosity fee of 4.5%.

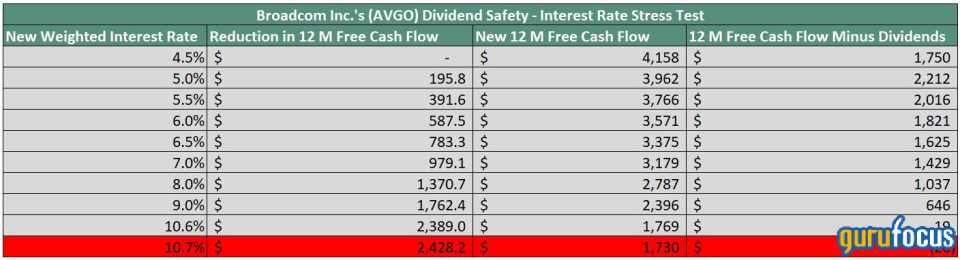

The table beneath illustrates exactly where Broadcoms weighted normal desire level would want to reach prior to dividends were not protected by the companys totally free cash stream.

Resource: Authors calculations.

Broadcoms weighted average curiosity rate would want to rise higher than 10.6% ahead of dividends have been not adequately protected by absolutely free dollars circulation. As this kind of, personal debt does not seem to be a important component in long run dividend payments.

Shares generate just in excess of 3% today, extremely near to the 5-yr normal generate of 3.2% and double the ordinary of the S&P 500 Index.

Valuation

Broadcom at this time trades close to $541, implying a forward price-earnings ratio of 14.7. The inventory has a 10-year ordinary value-earnings ratio of close to 14, so shares are at this time a little ahead of its prolonged-term average.

The GF Benefit chart shows that Broadcom is reasonably valued on an intrinsic basis.

With a GF Benefit of $523.41, Broadcom has a price-to-GF Value of 1.03, earning the stock a rating of pretty valued from GuruFocus.

Final feelings

Broadcoms 2nd quarter outperformed the average analysts estimate both on the top rated and base strains. The company knowledgeable advancement in critical regions, with the expectation that development would continue on and, in some cases, accelerate in the latest quarter.

The companys report-placing order of VMware will be a important addition and ought to toughness Broadcoms software small business even even further.

This possible usually means that Broadcoms dividend will proceed to see high rates of expansion amid pretty affordable payout ratios.

Even with a potent quarter and long term outlook, shares are trading very close to the two the historic multiple and its intrinsic value. Broadcoms enterprise model and dividend make the identify an great pick for people searching for know-how publicity.

This short article to start with appeared on GuruFocus.