New Delhi: June is eventually right here, and most of us are possibly eagerly anticipating or have currently gained our income boosts and bonuses.

So, what do we do instead?

Listed here are two easy hacks you can comply with to assure that you strike the ideal stability among shelling out your significantly-deserved bonus and income hike with no compromising on your upcoming discounts!

Relevant News

Top quality for flagship insurance schemes PMJJBY, PMSBY hiked

Some productive ways to preserve tax this monetary yr

Saving Hack 1: Raise your

Even a modest maximize each individual year can make a big big difference to your remaining portfolio price over the extended run. An enhance in SIP amount each and every yr can help you to-

* Access your economical objectives more rapidly

* Broaden your financial goals (eg afford to pay for a sedan instead of a hatchback)

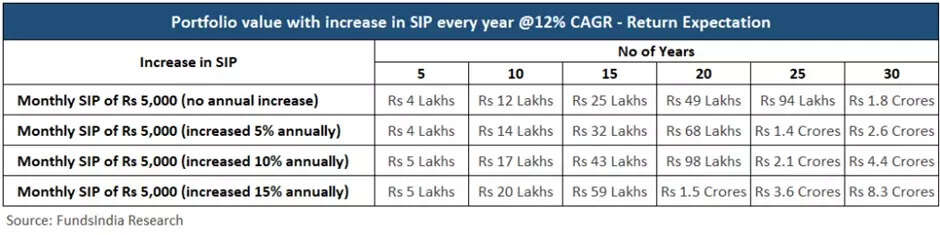

Let’s see how your portfolio looks without having an enhance in SIP and with an increase in SIP each 12 months.

Assume you are investing Rs. 5,000 each thirty day period via SIP and your expense earns a return of 12% CAGR. The value of your portfolio right after 20 decades would be close to Rs 49 lakhs.

Now arrives the exciting section. What do you feel would be the price of your portfolio if you experienced enhanced your SIP say by 10% each calendar year? The worth of your portfolio following 20 yrs would be pretty much Rs 98 lakh (vs Rs 49 lakhs) if you boost your SIP each year by 10%.

More than a prolonged time body (i.e 20 several years), your portfolio benefit when you improve your SIP each individual calendar year by 10% is just about two times the primary portfolio with a continuous SIP total each individual yr!

Here is a desk that exhibits the variation in last portfolio values across unique time frames for distinctive % of the annual will increase in SIP amount.

Preserving Hack 2: Invest at least 50% of the reward quantity as per your existing asset allocation plan

When it comes to your bonus, make confident you established apart at minimum 50% of your reward and devote it again into your extensive-time period portfolio as for every your authentic asset allocation. Right here is how you can deploy your dollars at the existing juncture

Equity:

40% of the Equity amount can be promptly deployed in a person go

60% of the Fairness volume can be deployed in a staggered fashion – by way of weekly STP about 3 months

Debt:

The total Financial debt total can be right away deployed in a person go

Right here will come the very good information – You can commit the remaining 50% of your reward as you be sure to!

So, keep in mind these two straightforward saving hacks when you get your income hike and bonus,

1. Enhance your SIP each and every calendar year as your wage grows – ideally goal to boost your SIP by 10% or a lot more.

2. Save at minimum 50% of the reward total and invest as for every your present asset allocation.