China: worse | Financial Times

This write-up is an on-web-site variation of our Unhedged newsletter. Indicator up right here to get the e-newsletter despatched straight to your inbox just about every weekday

Very good morning. We have been pessimistic about China. But not pessimistic plenty of, as you will see down below. We are taking tomorrow off as Rob flies to London and Ethan operates on non-Unhedged jobs. We’re again with you Thursday. Electronic mail us: [email protected] and [email protected].

China advancement: worse

The past time we wrote about China, at the close of final month, the subject matter was the country’s “impossible trilemma”. Resolving concurrently for 5.5 per cent economic development, a stable financial debt-to-GDP ratio, and zero Covid-19 is difficult. Given this, the shorter-term route of least political resistance for Beijing is supporting advancement by pouring financial debt into low-efficiency serious estate/infrastructure initiatives. Modern noises from Xi Jinping make it crystal clear that the country plans to consider the easy route yet again.

But it turns out that describing the predicament as a trilemma is far too generous. Horrific economic information from China in April implies that the zero-Covid coverage may possibly be inconsistent with nearly anything but meagre progress, even in the existence of authorities attempts at stimulus.

In this article is what April looked like in China:

-

Retail profits down 11 per cent from a year previously, in opposition to an envisioned drop of significantly less than 7 for each cent.

-

Industrial generation dropped 2.9 per cent.

-

Manufacturing was notably weak, with auto production slipping 41 per cent.

-

Export development was 4 per cent, a screeching slowdown from 15 for each cent growth in March.

-

Serious estate exercise collapsed, with building commences falling 44 (!) per cent

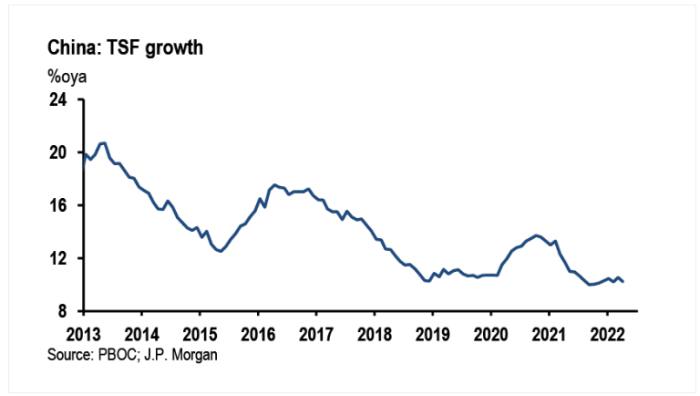

The backdrop for all this is credit rating expansion that stubbornly refuses to speed up, despite plan tweaks (this kind of as past months reduction of banks’ reserve demands) and jawboning from the authorities. Listed here is a JPMorgan chart of full social financing (TSF) — a broad authorities evaluate of credit creation — by April:

JPMorgan’s Haibin Zhu breaks the sideways sample into three items:

(1) contraction in house loans, as marketplace info advise even more deceleration in property sales (2) notable slowing in medium to extended-phrase loans to the company sector, reflecting weak credit desire for corporate sector funding and investment (3) moderation in federal government bond issuance.

Number 1 speaks for alone. China’s real estate business is undergoing a wholesale restructuring. Homebuyers are heading to be treading cautiously.

As for amount 2, the vital phrase is “demand”. Why would a corporation want to threat a major new investment, even if financial institution funding had been readily available, when the zero-Covid plan has an believed 300mn metropolis dwellers beneath some kind of lockdown. How do we know it is a demand difficulty? Zhu pointed out “the discrepancy among decide on up in M2 [broad money] growth . . . and slowdown in financial loan growth . . . Accordingly, the ratio of new loans to new deposits fell to 86.2 for every cent.” Which is the least expensive ratio in five many years.

And so we convert to govt bond issuance, the go-to when the authorities would like to develop some advancement. But there is a awful issue there as perfectly, as my colleagues Sun Yu and Tom Mitchell pointed out in an fantastic feature very last week. Regional governing administration financing automobiles, a essential funding conduit for infrastructure initiatives, are experiencing constricted obtain to bank credit rating:

Bond issuance by LGFVs was just Rmb758bn ($112bn) more than the initial four months of this 12 months, down virtually 25 for each cent from the exact period of time in 2021. Many Chinese banking companies now prefer to lend to infrastructure jobs led by big condition-owned enterprises instead than LGFVs, which they see as much too dangerous.

The governing administration will possibly hold making an attempt to leap-begin issues. In excess of the weekend, for example, the home finance loan fee for very first-time consumers was slice. But while a handful of months ago brokers and pundits held out hope for a fillip from authorities motion, there is now escalating pessimism about how significantly in can help although the lockdowns are in put. Gavekal Dragonomics observed there is “a fundamental tension amongst maintaining the existing Covid prevention technique and lifting growth”, which renders fiscal stimulus ever more impotent — as demonstrated by low infrastructure investment decision in April.

This estimate from the FT understates the position nicely:

Zhiwei Zhang, chief economist at Pinpoint Asset Management, noted that the federal government was less than stress to launch new stimulus steps and that the home loan level slice was “one phase in that direction”. But he additional that “the usefulness of these insurance policies is dependent on how the authorities will ‘fine-tune’ the zero-tolerance plan versus the Omicron crisis”.

Good-tune! Folks never purchase new homes when they are locked in their aged types, and businesses don’t borrow when offer chains are shut down. Will the govt relent on zero Covid? No one looks to consider so. Right here is the spectacularly depressing signal-off estimate from Yu and Mitchell’s piece:

Handful of be expecting Xi to relax his zero-Covid marketing campaign before securing an unprecedented third expression in power at a social gathering congress later this 12 months. The method “has turn into a political campaign — a political resource to test the loyalty of officials”, says Henry Gao, a China professional at Singapore Management University. “That’s significantly a lot more critical to Xi than a couple of much more digits of GDP advancement.”

Both equally equity and credit score marketplaces in China capture this grim actuality:

Nevertheless, 1 way or an additional, faster or afterwards, the lockdowns will conclude. And there are some signals that the present wave of infections could be subsiding. Bloomberg noted on Sunday that overall scenarios in Shanghai were slipping, and that no new situations had been claimed outdoors of the city’s quarantine places in two days — nearing a essential threshold from relaxing lockdown protocols.

This sort of issue is plenty of to convey out the optimists. JPMorgan’s China equity tactic group has rolled out a record of shares that will “benefit [from] the Shanghai reopening theme”. They consist of transportation, semiconductor, vehicle pieces, and creating components providers. Hunting at the value chart previously mentioned, it is quite obvious that whoever occasions the reopening trade just right is likely to make some cash in these kinds of names. We want them nicely, but wouldn’t know how to time it ourselves.

What type of growth fee China’s economic system returns to is a individual question. Julian Evans-Pritchard of Funds Economics argued the crucial variables will be world wide need and the need of the governing administration to encourage following the lockdowns are lifted. He foresees a restoration that starts pretty quickly, but wrote that:

This restoration is most likely to be additional tepid than the rebound from the preliminary outbreak in 2020. Back then, Chinese exporters benefited from a surge in desire for electronics and purchaser items. In distinction, the pandemic-induced shift in expending styles is now reversing, weighing on desire for Chinese exports. Meanwhile, officials are having a a lot more restrained method to plan help this time . . . The upshot is that when the worst is ideally around, we believe China’s economy will battle to return to its pre-pandemic craze.

We agree with Evans-Pritchard about world-wide demand but disagree about govt restraint. Our guess — and that is the only term for it, admittedly — is that the futility of stimulus underneath lockdown will only increase the political very important for fiscal and monetary largesse immediately after lockdowns finish.

One good study

Depressing example of how capitalism works: the e-pimps of OnlyFans.

Advisable newsletters for you

Thanks Diligence — Top stories from the earth of corporate finance. Signal up in this article

Swamp Notes — Professional insight on the intersection of cash and ability in US politics. Sign up here