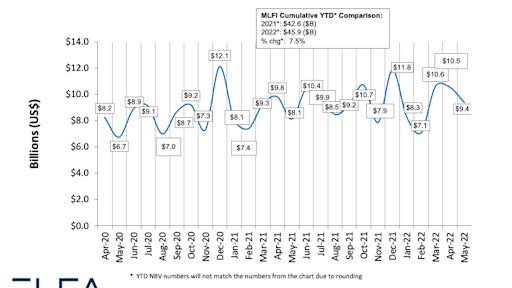

The Gear Leasing and Finance Association’s (ELFA) Month-to-month Leasing and Finance Index confirmed all round new small business quantity for May well was $9.4 billion, up 16% 12 months-about-calendar year from new company volume in May perhaps 2021.

ELFA

The Devices Leasing and Finance Affiliation (ELFA) has released its Month-to-month Leasing and Finance Index for Could.

The index, which reports financial activity primarily based on comments from 25 businesses within just the gear finance sector, was $9.4 billion, up 16% year-in excess of-12 months from new small business quantity in May 2021. Volume was down 10% from $10.5 billion in April. Calendar year-to-date, cumulative new organization volume was up almost 8% when compared to 2021.

“May action for MLFI-25 machines finance corporation contributors demonstrates potent origination volume and really stable credit history high quality metrics,” claimed Ralph Petta, ELFA president and CEO. “The overall economy carries on to deliver work opportunities and corporate The us, in normal, reports solid equilibrium sheets—all in the face of a waning overall health pandemic. Offsetting this superior news is higher inflation, creating havoc for lots of consumers, and continued source chain disruptions and bigger interest charges, which are squeezing significantly of the business sector. As a final result, many devices finance companies solution the summer months with guarded optimism.”

Receivables have been 1.6%, down from 2.1% the past thirty day period and down from 1.9% in the identical interval in 2021. Cost-offs were .12%, up from .05% the preceding month and down from .30% in the yr-before period.

Credit rating approvals totaled 76.8%, down from 77.4% in April. Total headcount for products finance corporations was down 3% year-in excess of-calendar year.

The Products Leasing & Finance Foundation’s Regular Self esteem Index (MCI-EFI) in June is 50.9, an increase from 49.6 in May possibly.