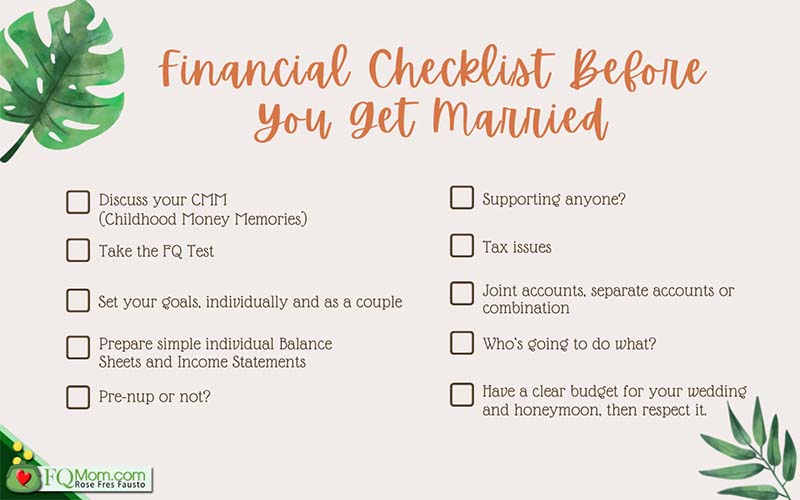

Financial checklist before getting married (applicable also to those already married)

Checklists are our hacks to make absolutely sure we cover all vital things in accomplishing jobs, whether they are tiny common ones or major initiatives.

Marriage is one particular enormous daily life venture. The late taipan John Gokongwei Jr. was quoted as indicating, “The most crucial determination you’re likely to make in your existence is whom you will marry.” And to make your marriage seriously work, a single of the critical features but not constantly reviewed is your shared cash values with your partner.

Today’s short article talks about 10 items that really should be in your fiscal checklist in advance of you say “I do.” These merchandise are continue to applicable to already married partners, in scenario you didn’t focus on this very well plenty of because you ended up caught up the in the thousand and just one things in your wedding checklist.

1. Focus on your CMM (Childhood Revenue Memories). Why? Simply because our funds triggers are ordinarily deep-seated in our childhood encounters about revenue. When you fully grasp each other’s CMM and the influence these experienced in your latest relationship with money, your variances in income values and actions can be dealt with much more healthily, staying away from contempt in the future when cash challenges occur. (Illustrations: 1. One particular who is so irritated by the spouse’s abundant relative it turns out he grew up with cruel loaded kin. 2. 1 does not want to speak about funds it is for the reason that she grew up observing his moms and dads combat about cash.)

In FQ Book 1, there is an training on CMM with guideline questions that will assistance you go again to your childhood and make it possible for you to unearth some activities that have grow to be your dollars triggers ideal now. This is the first phase to having a wholesome partnership with money.

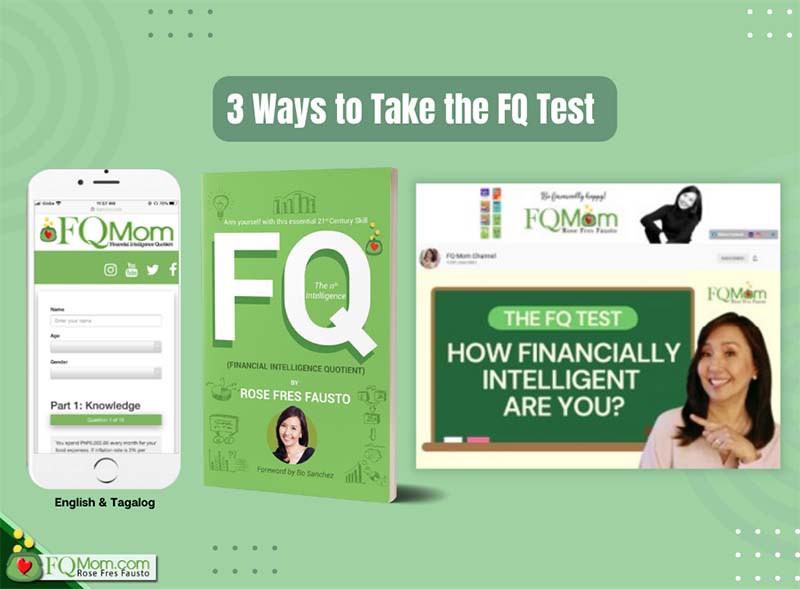

2. Consider the FQ take a look at. It is very critical to know in which every single associate is at when it comes to knowledge and conduct about money. There are 3 strategies to take the FQ examination now: a) on line exam and the fantastic information is it now will come in English and Tagalog b. aged school fashion printed take a look at by working with FQ E book 1 c) online video.

3. Established your aims, individually and as a couple. The target-location activity will provide you nicely when you go into the facts of your revenue administration as a couple. It is because revenue is your essential instrument in accomplishing your plans and dreams. Share your personal goals then test to occur up with one that will be the start off of your Spouse and children Aim Environment. When do you program to have youngsters? Obtain a household? Journey? What sort of life-style? I have produced various contents about this: 1, 2, 3. If you want to have a copy of the FQ Mom Goal Placing Template, you can send email to [email protected] with subject matter: Intention Setting Template, and we would be satisfied to send out you the excel file. Feel free to tweak it to go well with your possess tastes and needs.

4. Prepare straightforward personal Equilibrium Sheets and Income Statements. Right after you set your targets, get ready this essential monetary assertion that will clearly show your starting position. It is extremely hard to reach your aims if your starting place is not apparent. Make this a enjoyment exercise that is sensitive to your possess challenges about revenue. It is so significantly superior to know the money owed, resources, earnings resources, fees of each and every other now than be astonished afterwards on after signing the relationship agreement that legally binds you to each other.

5. Pre-nup or not? This is continue to a taboo topic for most Filipino households to discuss about. It is most likely the most unromantic point to chat about when a person is obtaining married. But hey, a great relationship can not survive only on romance. It has to choose in every little thing – each the lovable and unlovable components, the stunning and the unattractive facets of life. After seeing each and every other’s assets and liabilities in your respective Equilibrium Sheets, you are now greater geared up to make a decision whether or not your relationship will be much more thriving less than the typical provisions for assets possession in our constitution – i.e. Absolute Local community of Home, or execute your individual conditions and ailments below a Pre-Nuptial Agreement. But this is finest manufactured as a aware decision of the pair alternatively of just anything imposed by other functions.

6. Supporting any individual? This can be the unwritten section of the Harmony Sheet and Revenue Statement. Is anyone supporting anybody? Your mother and father? Siblings? A result in? It is greatest to examine this and make a decision what improvements, if any, will transpire as soon as you say “I do.” Keep in mind, for you to purpose effectively as a solitary device of modern society (certainly, that is the definition of family in our structure), you will have to be obvious on financial commitments since you will now be getting your own established of economical requirements as a family.

7. Tax concerns. You may well also incorporate figuring out if you are improved off filing your income taxes independently or collectively as a pair. This is a very well timed subject matter suitable now due to the fact it is tax year.

8. Joint accounts, individual accounts or blend. Determine out how you want to manage cashflows transferring ahead as a family members. Would you like to have separate accounts? Joint accounts? Or combination? A combination might be the best solution. No make a difference what your selection will be, it is continue to better to know about the existence of all the accounts, even if you really don’t deal with them. This guarantees that if just one goes away, the surviving partner is not still left clueless of the accounts still left guiding.

9. Who’s heading to do what? Come to a decision who will choose treatment of month to month budgeting, saving, investing, and other matters relevant to cash. Assign it in accordance to the partners’ abilities and fondness. Considering the fact that money could deliver nerve-racking situations when you’re married, it is greatest to assign the distinctive features of income management to the suited companions. But this is finest shared and under no circumstances make it possible for just one particular human being to know every thing while the other human being is totally clueless. Yet again, this is inclined to a disastrous end result not just in the party of death of the spouse exclusively in charge of the revenue, but also in the working day-to-day managing of relatives money. Is not it so substantially easier to accomplish your money plans if both equally of you know where you are?

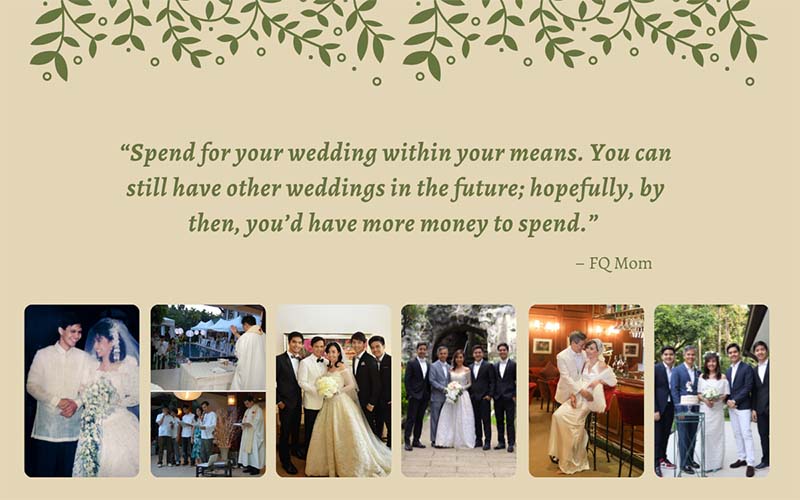

9. Have a crystal clear spending budget for your marriage ceremony and honeymoon, then respect it. Comparing our initial wedding day in 1989 and our silver marriage ceremony in 2014, I saw that so many points to expend for have been invented that can really set massive economical stress for the couple. No surprise, numerous are delaying their weddings these days. I know all these marriage gimmicks labeled as “must haves” are so thrilling to have, but often try to remember that this is just a person working day, no make any difference how essential it is. Really don’t go overboard and regret it just after. Here’s a idea I give youthful couples arranging their marriage, “Spend for your wedding ceremony within your indicates ideally, by then, you can even now have other weddings in the upcoming hopefully, by then you’d have additional funds to shell out.”

I hope this economical checklist before having married allows you have a Superior FQ Loved ones.

On Thursday, we will go on this conversation about making ready for a terrific marriage jointly with romance professional, Maribel Dionisio. Be a part of us.

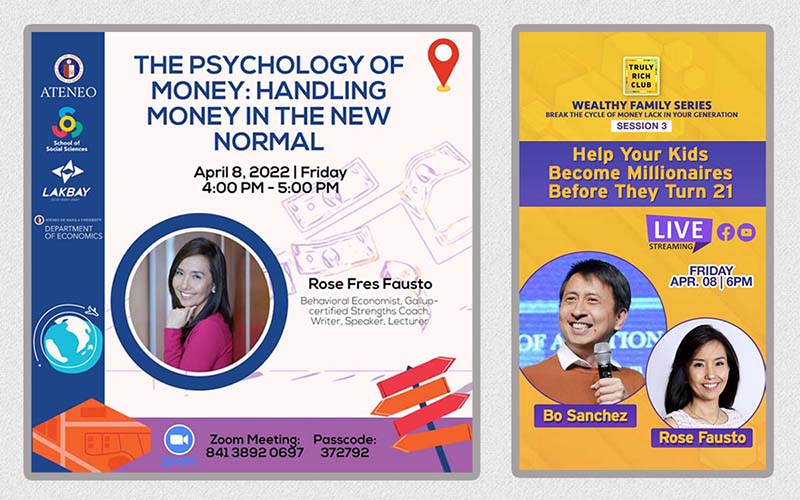

Announcements:

1. Back-to-back talks on Friday! Many thanks to the on line magic, this can be designed attainable!

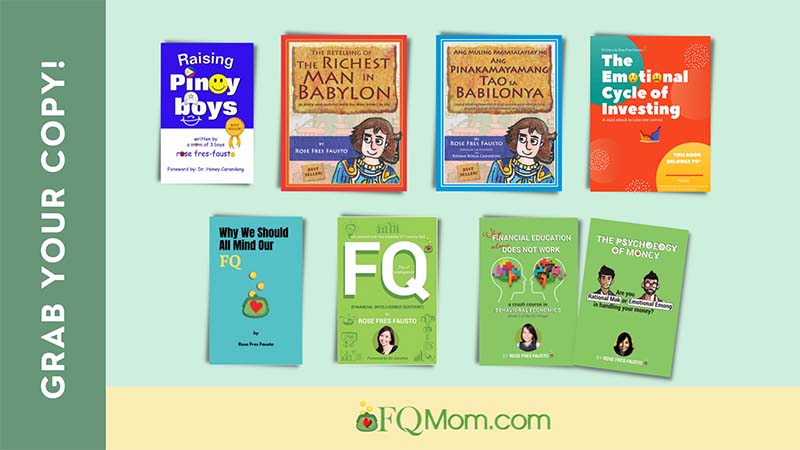

2. To learn much more about your funds behavior, get your copy of FQ Publications and for your liked kinds also. The rules you will learn from in this article are not only relevant in your financial everyday living but all the other vital facets of your lifetime. https://fqmom.com/bookstore/

To know far more about FQ Ebook 2, observe this small online video.

https://www.youtube.com/observe?v=tfpWOa64kh8