Four Loan Types Business Leaders Need To Know

When you have to have money as a Trader or True Estate Developer? You will absolutely use a single of these Bank loan kinds. Business people also want to know and digest what the 4 distinctive Mortgage forms are when Investing and using Personal debt automobiles or Borrowed income.

Kansas Town Non-public Loans, Kc Mortgages and Kansas Missouri Funding Accessible.

Get hold of Me Here NOW!

What you require to know?

What Is a Balloon Payment Loan

A balloon payment loan is a mortgage or bank loan in which does not entirely amortize above the term of the be aware, hence leaving a balance owing at maturity. The last payment is called a balloon payment due to the fact of its substantial dimensions. Balloon payment mortgages are additional typical in professional genuine estate than in household authentic estate.

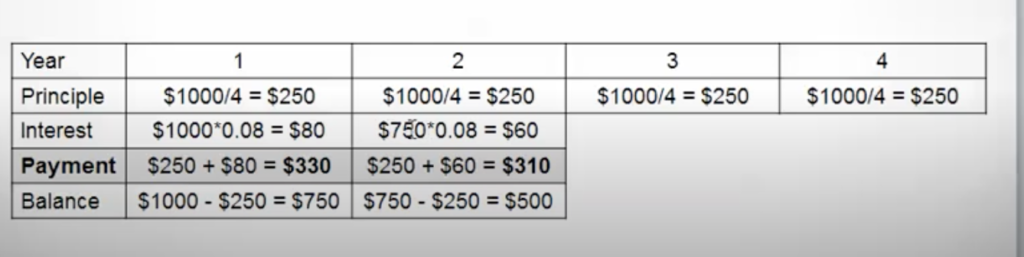

Consistent Amortization Loan

In this Approach of lending an equal portion of the basic principle is paid out at each and every period moreover curiosity variable.(On the financial loans Remaining Harmony)Paid in the starting of every single period of time. Example Image of the Routine of Paying the Principle and the chosen terms or further Interest.

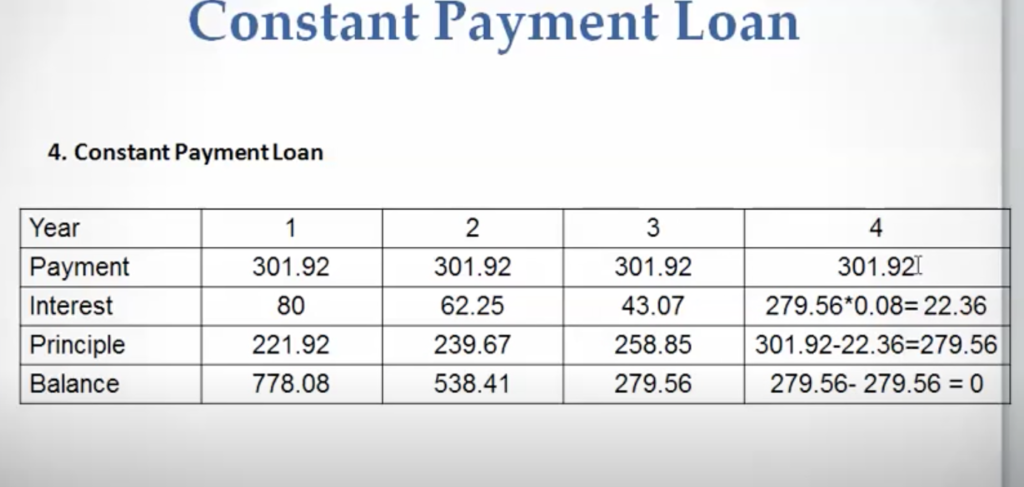

Regular Payment Bank loan

Consistent Payment Loan is what most who obtain a property refer to as a Mortgage. Nonetheless in the earth of Real Estate this mortgage case in point is a straightforward Financial loan additionally interest program you pay back in excess of the lifetime or duration of the Theory.

Right here is a Instance impression of the Very simple Calculation of Frequent Payment Personal loan and Interest Schedule.

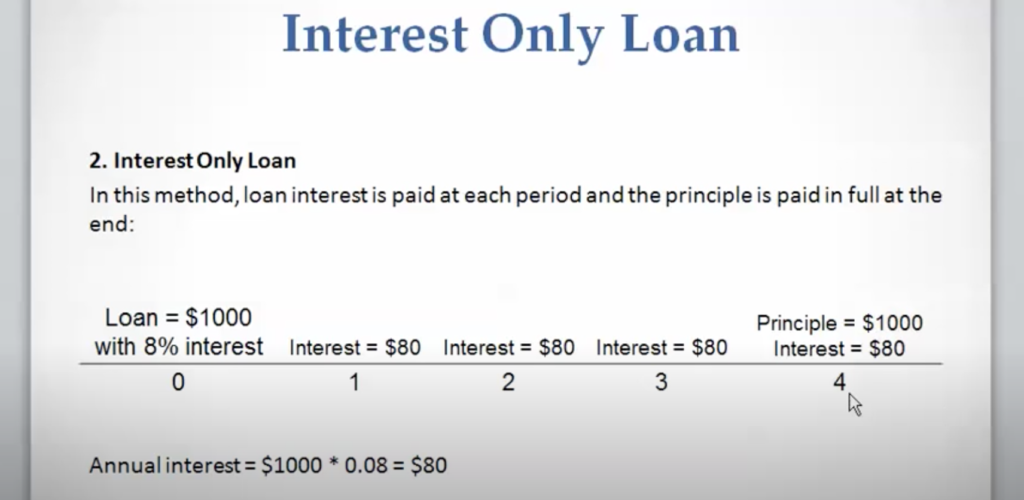

Fascination Only Mortgage

An interest only Loan is the easiest type of Desire payment mortgage plan. Indicating you shell out a percentage of Curiosity on the Principal every year over the lifestyle or period of the financial loan. Until finally the bank loan is paid out off. Straightforward. But here is a impression to exhibit to individuals who could have problems computing the program. If your anything like myself? I usually need additional enable. Your in good business.

Loans Curiosity payments are effortless to compute as a Business enterprise chief if you have an understanding of the basic principles. This publish will assist everyone getting in True Estate of needing to study what Repayment of Mortgage fascination truly indicates.

I truly hope you realized a thing right now. As this write-up was intended to be lean and indicate. I did not want to pose how to work out the Fascination payments. Mainly because typically occasions you will turn into confused studying the verb-age. So just youtube the Payment Calculations of the financial loan varieties. This submit was just intended to demonstrate what and how things function in the planet of Fascination loans and Amortization schedules. Cheers to all the Bankers in Finance, and Home loan Brokers out there. This Post was sparked immediately after I discovered that a fantastic guy and Titan in the New York Actual Estate Community passed last Tuesday. Just I was observing a Job interview and listened to Larry begin to communicate about the Loan types with Son Bill in everyday Dialogue. And decided I needed to observe up on the Finance Slang and kinds they were talking about. And Viola this put up was born.

R.I.P. to the Very good and Terrific Mr. Larry Ackman.

Godspeed and Cheers To Larry.

JS