Image supply: Getty Visuals

A organization price range can aid you retain prices underneath command and grow income. Discover how to make a company budget for your small enterprise in 5 actions.

If you’ve just commenced your business, prospects are that you have still to build a funds. But it’s hard to develop your enterprise, satisfy any shorter- or extensive-phrase aims, or attain outside the house traders or financing devoid of precise economic projections, which needs a little organization spending plan.

Developing a finances also plays an critical role in the the accounting cycle, which guarantees that all financial transactions are correctly accounted for.

And although the act of building a price range may seem to be challenging, it is a great deal like generating a own spending budget. You discover what you own of benefit (your property), estimate your upcoming charges, and account for and increase your income base.

If you know how to produce an cost report or how to compose an bill, and are snug with the fundamentals of bookkeeping, you can definitely tackle business finances preparing.

By generating, and much more importantly, adhering to a finances, you can reduce wasteful spending, produce plans to extend your income base, and do the job toward your set targets in a successful trend.

5 sorts of budgets for enterprises

Budgets assist businesses monitor and deal with their methods. Firms use a range of budgets to evaluate their shelling out and create efficient approaches for maximizing their property and revenues. The adhering to forms of budgets are normally employed by companies:

1. Grasp finances

A grasp spending budget is an aggregate of a firm’s personal budgets built to present a comprehensive image of its money action and health. The learn funds brings together aspects like revenue, operating charges, assets, and profits streams to allow firms to create ambitions and appraise their total general performance, as perfectly as that of specific cost centers in the organization.

Grasp budgets are typically applied in larger sized corporations to keep all particular person managers aligned.

2. Functioning finances

An running budget is a forecast and examination of projected money and costs around the program of a specified time period of time.

To build an correct picture, operating budgets should account for components this kind of as product sales, output, labor charges, resources prices, overhead, production expenses, and administrative costs. Running budgets are typically designed on a weekly, month-to-month, or yearly basis. A supervisor could compare these stories thirty day period just after thirty day period to see if a corporation is overspending on provides.

3. Dollars flow funds

A cash movement spending budget is a usually means of projecting how and when cash will come in and flows out of a business enterprise within a specified time interval. It can be valuable in supporting a business ascertain no matter whether it really is taking care of its income wisely.

Cash stream budgets look at things these as accounts payable and accounts receivable to assess no matter if a organization has enough funds on hand to continue running, the extent to which it is working with its dollars productively, and its chance of building income in the in close proximity to future.

A design business, for illustration, could use its money move funds to ascertain no matter if it can get started a new setting up job ahead of getting paid out for the function it has in development.

4. Financial spending plan

A monetary funds provides a firm’s tactic for running its property, money movement, income, and expenses. A financial spending budget is applied to establish a photo of a firm’s money well being and existing a complete overview of its paying out relative to revenues from main functions.

A computer software organization, for instance, may possibly use its economical spending plan to establish its worth in the context of a general public inventory presenting or merger.

5. Static spending budget

A static funds, as opposed to a flexible funds, is a fixed spending budget that remains unaltered no matter of alterations in components this kind of as sales volume or revenue. A plumbing supply company, for illustration, may have a static spending budget in area every yr for warehousing and storage, regardless of how much inventory it moves in and out due to improved or diminished gross sales.

How to make a funds for your tiny business

One particular of the least difficult and most accurate methods to develop a spending plan is to evaluation your profits and fees for the earlier yr and use individuals numbers when producing your new finances.

If your business enterprise is model new, you’ll have to be a bit additional innovative, relying on acquiring numbers from the final couple months, or exploring comparable organizations to receive accurate estimates on revenue and expenditures.

Nevertheless you do it, studying budgeting for enterprise is a good deal less complicated than you consider.

Action 1: Critique your income

The initial action toward producing a funds is to examine your income: not just the overall for any provided time, but details, this kind of as months when income rose or dipped. This is especially important for taking care of cash movement.

For instance, quite a few shops make a large section of their annually earnings in the months of November and December, whilst January and February usually are incredibly slow in profits.

Knowing this facts and together with it in your spending plan can help you be better ready for both equally the chaotic and the sluggish months.

Action 2: Take a look at your set costs

As a smaller business proprietor, you need to know what your regular month-to-month expenses are. If you know how to keep track of organization fees such as lease, insurance policy, salaries, and utilities, you can make a finances.

Factoring these items into your spending budget assists to guarantee that you’re accounting for these charges adequately.

Action 3: Variable in variable charges

Whether or not in our private lives or in business enterprise, we need to have to factor in variable expenses.

For occasion, you may perhaps want to employ the service of a temp if your office manager becomes unexpectedly sick. Other variable expenses can contain promotion and marketing, as well as postage or printing prices. Journey is another value that may be planned (you know you are likely to a conference in Might), but the final cost is not but known.

Factoring in variable fees can help with your bottom line. Really do not be conservative in estimating these expenditures, You’d fairly they be far too superior, leaving you a lot more money than anticipated for the month than the reverse.

Action 4: Consist of one particular-time and unexpected fees

Even though it may possibly appear counterintuitive to include things like sudden prices into your budget when they have not even happened still, you can securely think that a little something unforeseen will materialize.

Your computer system crashes and desires to be fixed, or even worse, changed. Or maybe your company car dies. These are equally illustrations of sudden costs. You can also strategy for 1-time charges.

For instance, you know you’ll be upgrading staff laptops in December. This permits you to prepare for this cost in advance, guaranteeing that the cash must be offered.

Action 5: Put all your information into a finances format

The best situation is to get ready your budget facts in your accounting software application.

Even so, not all accounting software package, especially all those designed for tiny businesses, consist of a budgeting feature. In that situation, you can use Microsoft Excel or identical spreadsheet application to prepare your finances.

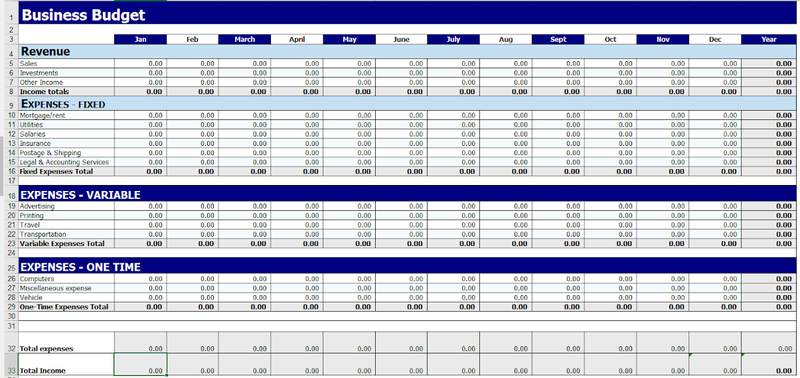

This Microsoft Excel spreadsheet can be utilized to make your enterprise price range. Image source: Creator

One of the principal pros of planning a spending budget in your accounting software program software is that you can track funds compared to real profits and fees. This lets you see how precise (or not) your finances is, allowing for you to probably make some mid-yr adjustments.

Factors to contemplate when producing a spending budget for your company

Creating a funds is a terrific to start with phase towards running your small business correctly. Even so, it is critical when producing your budget that you do your greatest to make it as accurate as feasible. There are a lot of techniques to do that, together with the subsequent:

1. Be conservative with revenue

When entering income totals, be conservative. At the starting of the yr, we’re all optimistic. But be positive when you spending plan your profits, you enter numbers that are as accurate as attainable.

When scheduling for profits expansion, be conservative as effectively, most likely budgeting for a 5%-10% advancement for the calendar year. If you exceed that degree, good. You are going to have funds to spare. But if you never, you’ll conclude up with a reduction, which is not exactly where you want your small business to be.

2. Plan for progress

Organizing for advancement is important when calculating spending plan income, but you are going to have to account for additional fees as perfectly.

Certainly, if your small business grows, your profits will enhance, but so will your overhead, as you boost advertising and marketing, include staff members, and pay out more taxes. So when setting up for small business progress, be sure to factor in your increased costs as perfectly.

3. Sudden fees

This is an significant 1. One particular disaster can be disastrous for your company, particularly if you function on constrained income flow.

When budgeting, just presume that your organization will have at least a single significant unforeseen expense all through the year. If it doesn’t, great. You can financial institution that revenue for when the surprising does arise.

4. Prolonged-term targets

Prior to finishing your funds, you may want to consider your lengthy-term goals.

Do you program on growing your shopper foundation each 12 months by 5%? Possibly you are operating out of your residence, but plan on leasing or purchasing a creating for your organization in the subsequent 12 months or two.

Be positive to issue that into your finances, and program your cash flow and costs accordingly.

The ideal accounting computer software for tracking your tiny organization funds

Not just about every accounting software package software gives budgeting ability, but the following smaller enterprise accounting software program purposes do.

If you’re wanting to make the go to accounting program, or are searching for an application that makes it possible for you to produce and deal with a funds for your small business, be sure and verify out these applications.

1. Xero

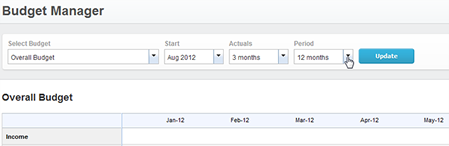

Xero lets you very easily produce a finances making use of their Finances Manager element. You can decide on your start off day for any spending budget, and get ready a spending plan of 3, 6, 12, or 24 months. Xero also will allow you to evaluate any produced funds to actual totals, to see how significantly under or more than funds your organization is.

The Budget Manager lets you pick out start out day, actuals, and period of time for just about every funds. Image resource: Writer

You can duplicate funds facts from actuals for the prior yr, copy facts from an present spending budget, or develop a new price range from scratch. Changes can be built for just about every price range time period, so you can modify the total each individual thirty day period to improve budgeted totals by a set amount of money or by share. This is a great way to finances for progress.

2. QuickBooks On the internet

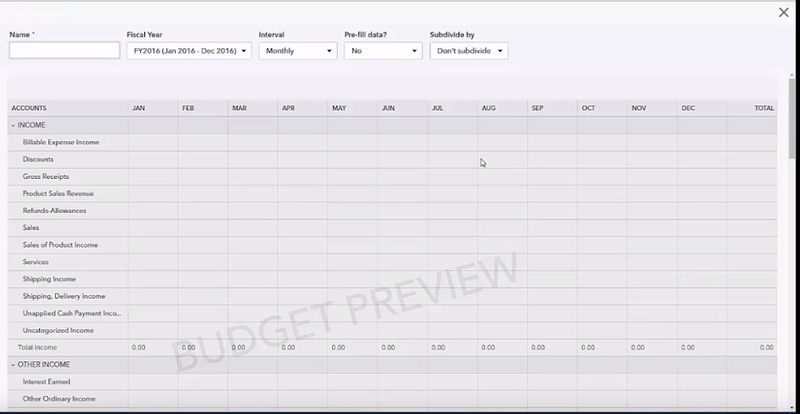

The budgeting aspect in QuickBooks Online allows you make a yearly funds very easily. Just pick the correct fiscal 12 months, simply click on the “Add Budget” button, and start off moving into price range facts.

You can choose to pre-fill price range facts employing precise QuickBooks On-line details or just develop a spending plan from scratch. You have the solution to produce a every month, quarterly, or annually spending plan, and can opt for to subdivide your price range by consumer, class, or spot, or just enter a single whole into the appropriate fields.

The Funds Preview characteristic allows you preview your freshly made budget for precision. Graphic source: Creator

Spending plan information can be edited when preferred, and to get a perception of your small business overall performance, operate the Price range vs. Actuals report, which displays present-day enterprise overall performance to day.

3. Zoho Textbooks

Zoho Publications gives fantastic budget development ability, supplying a few means to enter spending plan details:

- Vehicle-fill spending plan information and facts dependent on current money and price accounts

- Pre-fill from very last year’s precise figures

- Start out from scratch, entering price range quantities manually

Like Xero, Zoho Publications allows you enter spending plan numbers for a solitary time period, then specify a share boost or lower in budgeted figures.

For occasion, if your brief-time period plan for this 12 months is to maximize your profits by 5% each individual quarter, you can enter that information and facts in Zoho Publications, and it will quickly work out the 5% maximize and auto-fill the rest of the finances. You can also utilize a mounted volume for just about every interval.

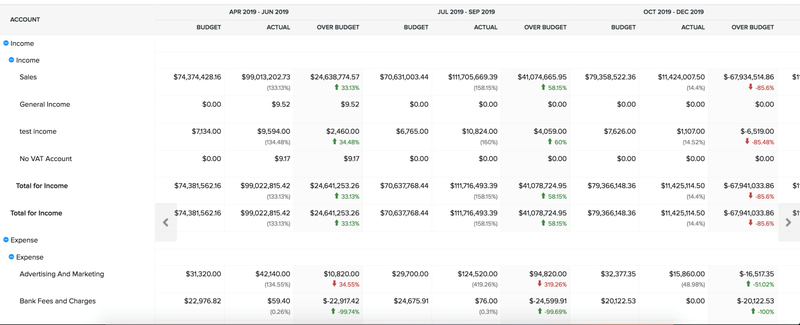

Zoho Textbooks offers a detailed spending budget management feature with several entry choices. Image resource: Creator

At the finish of the specified finances period of time, you can evaluate actuals towards your budgeted amounts to check out company general performance and make any adjustments going forward.

Get began on your spending plan right now

Now that you know how easy it is to prepare a spending plan for your small small business, what are you ready for?

Completing a spending budget for your enterprise will offer you with the information and facts you want to grow your organization, approach for the unanticipated, and keep on monitor for the potential.