ipopba/iStock by means of Getty Pictures

New Mountain Finance (NASDAQ:NMFC) is a organization enhancement corporation with a growing and nicely-managed portfolio, floating exposure that implies better portfolio cash flow as fascination rates increase, and a minimal non-accrual fee.

Also, the small business enhancement business covers its dividend payments with internet expenditure money, and the inventory now trades at a 13% price reduction to ebook price. The inventory is interesting to dividend buyers trying to get substantial recurring dividend income, even though NMFC’s minimal valuation relative to reserve price leaves space for upside.

Buying A 10% Produce At A Low cost

Under the Expense Company Act of 1940, New Mountain Finance is categorized as a Company Growth Organization. The BDC is managed externally, which implies it pays one more organization for administration expert services. New Mountain Finance mostly invests in center-market place firms with EBITDA of $10 to $200 million.

The the greater part of New Mountain Finance’s investments are senior secured debt (initially and next lien) in industries with defensive traits, which usually means they have a substantial likelihood of carrying out well even in recessionary environments. New Mountain Finance’s main business is center marketplace credit card debt investments, but the corporation also invests in web lease attributes and fairness.

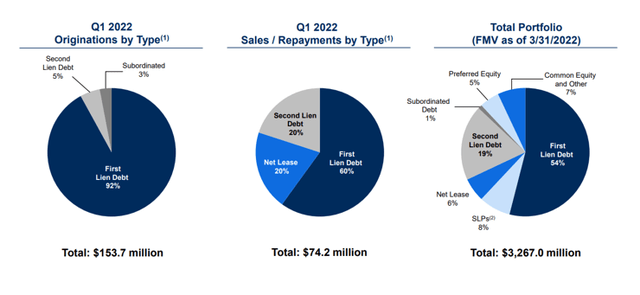

As of March 31, 2022, New Mountain Finance’s portfolio was composed of 54% initially lien financial debt and 19% 2nd lien financial debt, with the remainder spread throughout subordinated financial debt, fairness, and internet lease investments. In the initial quarter, just about all new personal loan originations (92%) were 1st lien personal debt.

The whole exposure of New Mountain Finance to secured 1st and second lien personal debt was 73%. As of March 31, 2022, the firm’s full portfolio, together with all credit card debt and equity investments, was $3.27 billion.

Portfolio Summary (New Mountain Finance Corp)

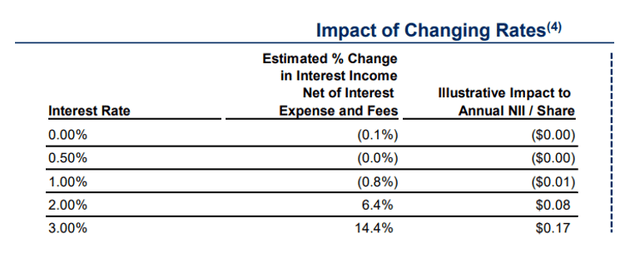

Desire Amount Publicity

New Mountain Finance has taken care to devote mostly in floating charge credit card debt, which guarantees the financial investment company a financial loan level reset if the central lender raises curiosity prices. The central lender raised curiosity costs by 75 foundation points in June to battle climbing inflation, which hit a four-10 years higher of 8.6% in Could. An maximize in benchmark desire costs is anticipated to result in a sizeable enhance in web fascination money for the BDC.

Effects Of Changing Premiums (New Mountain Finance Corp)

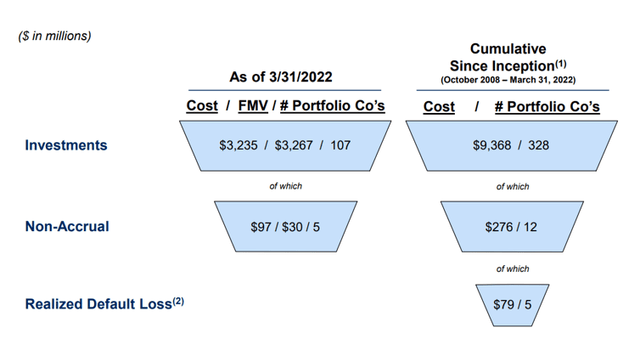

Credit history General performance

The credit rating overall performance of New Mountain Finance is fantastic. As of March, 5 of 107 companies had been non-accrual, symbolizing a $30 million honest value publicity. Considering the fact that the BDC’s overall portfolio was truly worth $3.27 billion in March, the non-accrual ratio was .9%, and the business has yet to understand a decline on all those investments.

Non-Accrual Ratio (New Mountain Finance Corp)

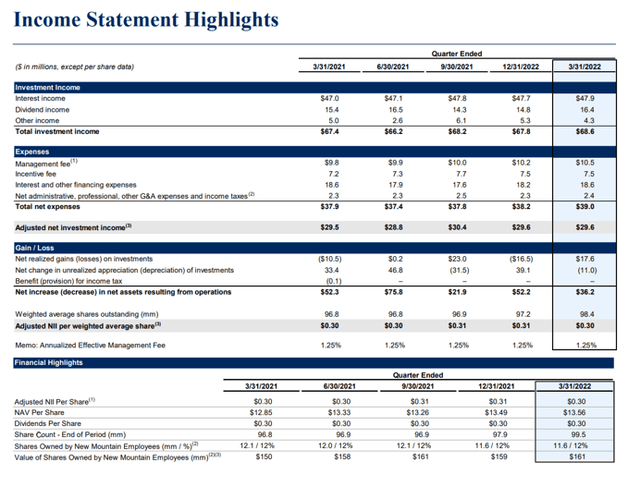

NII Covers $.30 For every Share Quarterly Dividend Spend-Out

New Mountain Finance’s dividend of $.30 for every share is coated by modified internet investment decision money. In the past yr, New Mountain Finance had a pay out-out ratio of 98.4%, indicating that it has constantly lined its dividend with the cash flow produced by its personal loan investments.

Even however New Mountain Finance at this time handles its dividend with NII, a deterioration in credit history top quality (personal loan losses) could bring about the BDC to underneath-earn its dividend at some stage in the long term.

Profits Assertion Highlights (New Mountain Finance Corp)

P/B-Multiple

On March 31, 2022, New Mountain Finance’s guide value was $13.56, although its inventory selling price was $11.84. This means that New Mountain Finance’s expense portfolio can be obtained at a 13% discount to ebook value.

In latest months, BDCs have begun to trade at better reductions to e-book benefit, owing to concerns about rising desire costs and the chance of a recession in the United States.

Why New Mountain Finance Could See A Decrease Valuation

Credit high quality and ebook value trends in enterprise enhancement companies demonstrate buyers whether they are dealing with a reputable or untrustworthy BDC. Corporations that report inadequate credit rating high quality and e book benefit losses are normally compelled to lessen their dividends. In a downturn, these BDCs ought to be averted.

The credit score excellent of New Mountain Finance is strong, as calculated by the level of non-accruals in the portfolio. Credit quality deterioration and guide price losses are hazard variables for New Mountain Finance.

My Summary

New Mountain Finance is a properly-managed and reasonably priced business enterprise advancement company to spend in.

Presently, the inventory price is decrease than the NMFC’s ebook worth, implying that the BDC can be acquired at a 13% lower price to e-book worth.

Additionally, New Mountain Finance’s total credit good quality appears to be favorable, and the organization improvement organization handles its dividend payments with internet expense earnings.