RiverNorth Specialty Finance: Taking An Updated Look At RSF

da-kuk/E+ via Getty Images

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on May 8th, 2022.

RiverNorth Specialty Finance Corp (NYSE:RSF) is a unique closed-end fund due to it being a publicly-traded interval fund. These are incredibly rare, as RSF and BlackRock Enhanced Government Fund (EGF) are the only two that I’m aware of. Of course, I could be missing some, and I’d be curious if others knew of any that could reach out.

This type of structure is typically privately held. Generally, the only way to liquidate from these interval funds is the quarterly, semi-annual or annual redemptions that they do between 5% and 25%.

Over time, the amount of assets held will be less and less unless they can have such strong performance year after year to offset these redemptions. It certainly is possible but not probable when redeeming 5% each quarter. That being said, investors aren’t required to participate either. They can pass up the opportunity to redeem. As we’ve seen with tender offers from traditional closed-end funds, not everyone participates.

There seem to be plenty of these funds structured this way that are private. When being publicly traded, that is essentially the investor’s liquidity there. They have the opportunity to sell whenever they want through the market day.

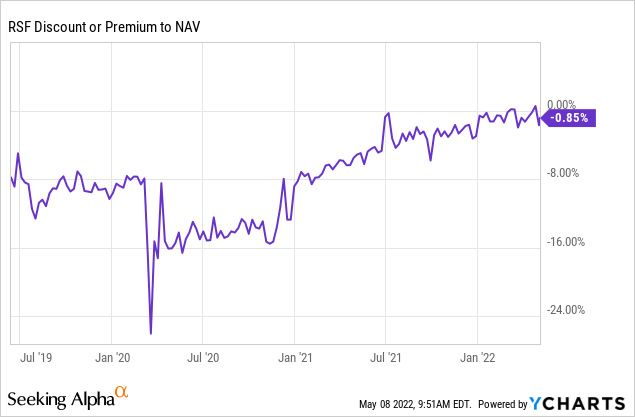

However, the publicly traded interval fund isn’t without its benefits too. In this way, the fund shouldn’t trade at a discount that is too wide. The reason being is that these quarterly redemptions from RSF act as mini-tender offers throughout the year.

Allowing investors to get out at the NAV per share amount rather than whatever the market is willing to pay at the time. The fund is right near parity with its NAV as of writing. Curiously though, the fund had previously been at some massive discounts. Discounts as wide as 15%+ for a brief period through 2020.

When a discount opens up in this fund, there could be an added benefit here to invest. That being said, I think it still means that you should want exposure to the underlying assets. Buying a fund at a discount and then participating in the interval structures quarterly redemptions is fine but should only be seen as a bonus.

How Does RSF Invest?

Before touching on some other topics on the fund, I think looking at how this fund invests is quite important. This is usually important, but their approach can be a bit more confusing.

This fund invests in a unique mix of small business whole loans, investment company debt and SPACs mostly. There is also some other CEF, BDC and ETF exposure that is quite minimal. There aren’t too many funds that invest in single loans directly.

RSF Asset Allocation (RiverNorth)

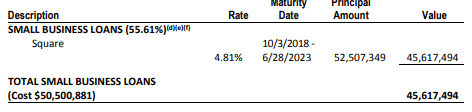

The “whole loans” part is quite interesting here. It is through Square Capital. Here is what they have to say in their report about Square;

Square Capital – An invitation-only advance on the sales that retailers make through Square’s point of sales system. It’s essentially a merchant cash advance, meaning that you pay a fixed fee rather than interest and repay the funds with a percentage of your daily sales.

They previously invested in consumer loans, so this is a transition away from those. The last time we took a look at the fund in 2020, they had touched on the name change and this strategy shift.

Going forward, we expect to continue purchasing small business loans originated by Square Capital given the low duration profile of this asset and, in our view, favorable return outlook and strong historical performance. In addition, we will continue to selectively deploy capital across closed-end funds, including BDCs, when we view valuation levels as attractive or there is a favorable issuer-specific catalyst. SPACs, which are a growing allocation within the Fund, present a positive asymmetric return opportunity, in our view, and we are actively deploying capital at opportunistic levels in both the primary and secondary market. While spreads have meaningfully tightened across investment company bonds, we continue to believe that the risk-adjusted return profile of these notes are attractive relative to other investment grade fixed income products.

In their Semi-Annual Report, it looks a bit unusual because this is then all lumped into one holding when it is ultimately many whole loans.

RSF Semi-Annual Report (RiverNorth)

In prior Annual Reports, they had listed every loan position. It was nearly 8200 loans when we last looked. However, it seems they don’t list the exact number anymore. Perhaps, too many that they lost count. These loans ranged from a couple of hundred dollars to several tens of thousands.

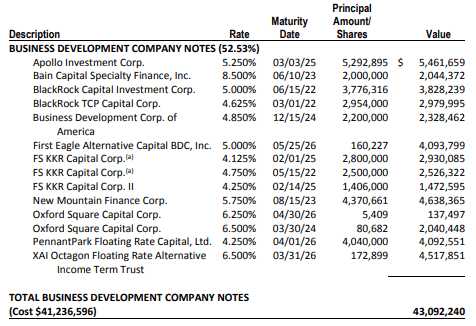

Additionally, few funds hold meaningful exposure to investment company debt. These are CEF or BDC senior notes or preferred that they issued to raise debt.

In RSF’s case, they appear to tilt towards BDC issuances. XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) seems to be the only CEF preferred they are holding. That would be the XAI Octagon Floating Rate & Alternative Income Term Trust 6.5% Preferred (XFLT.PA).

This is the second-largest exposure of the fund’s assets. We see a nice mix of different exposure here, which can benefit from diversification.

RSF Semi-Annual Report (RiverNorth)

I think this is quite appealing and wouldn’t mind seeing a fund invest solely in CEF and BDC notes and preferred.

The Basics

- 1-Year Z-score: 0.96

- Discount: 0.85%

- Distribution Yield: 10.64%

- Expense Ratio: 2.92%

- Leverage: 35.4%

- Managed Assets: $116.99 million

- Structure: Interval

RSF’s investment objective is “a high level of current income.” They attempt to achieve this through “investing in credit instruments, including a portfolio of securities of specialty finance and other Financial companies that the Fund’s Advisor, RiverNorth Capital Management, LLC believes offer attractive opportunities for income.” They have no restrictions on maturity or credit quality.

The fund is small and will continue to get smaller due to the interval structure, plus the fund’s distribution policy is also conducive to a slow liquidation.

For investors that focus on fees, this fund is probably a no-go. The expense ratio comes to 2.92%, but then it climbs to 7.30% when including leverage expenses and loan service fees. This is putting it towards the likes of the CLO funds with their ~10% expense ratios.

The fund’s leverage is through its preferred offering, the 5.875% Series A Preferred Stock Due 2024 (RMPL.P). The leverage amount will continue to climb, given the reduced assets over time.

Performance – Holding Up Fairly Well, But Expensive Here

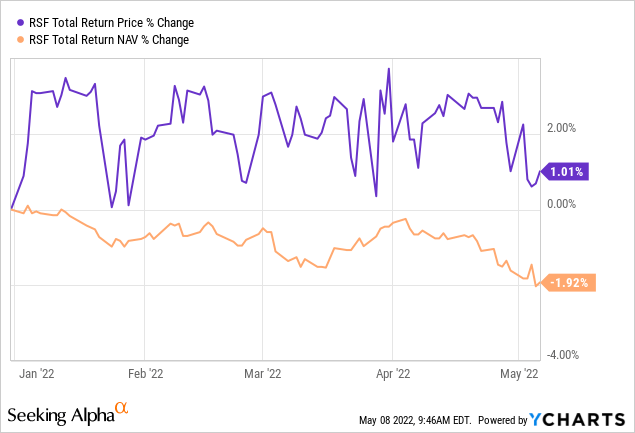

Given the high expense ratio and the rather poor market performance in 2022, you might think RSF would be doing terribly. Interestingly though, the fund has been holding up relatively well YTD. The total NAV return is down only slightly, but on a share price basis, investors actually have seen positive returns.

Ycharts

In 2021, the fund provided some attractive returns as well. On a total NAV basis, it worked out to be a 19.17% return. That was even with its 6.54% expense ratio that it had in that fiscal year.

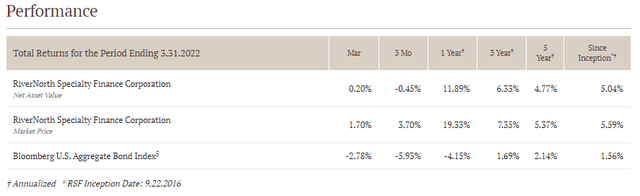

Since the fund’s inception, returns have been poor overall. However, that’s less relevant given the transition the fund has undertaken now over the last couple of years. Despite that, the fund still shows that it is outperforming the Bloomberg U.S. Aggregate Bond Index in all periods. They state that it is used as a broad market comparison only. That makes sense because it isn’t invested similarly to RSF.

RSF Annualized Performance (RiverNorth)

The fund’s discount at this time is almost nonexistent. This means that unless you really like the underlying holdings, there isn’t another significant reason to invest in this fund at this time.

Ycharts

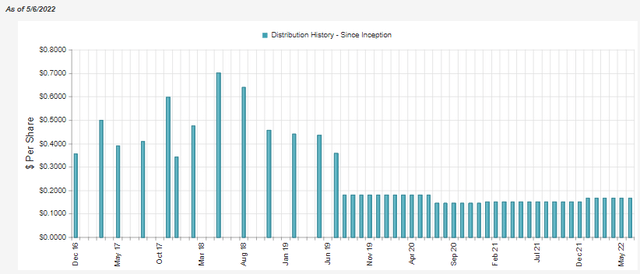

Distribution – Managed 10% Policy

This fund has a distribution policy that is based on 10% of its NAV at the end of the calendar year.

In accordance with its level distribution policy, RSF’s annual distribution rate has been set equal to 10.00% of the of the Fund’s NAV per common share as of the final trading day of the preceding calendar year.

10% is quite the lofty hurdle to climb, especially with such a high expense ratio. Though we know, they were able to pull it off in 2021. That resulted in investors receiving a boost for the year.

RSF Distribution History (CEFConnect)

If things don’t improve, though, we would see a small cut from here if it were reset today. Overall, I don’t mind these managed plans as it means cuts or boosts are predictable. At least until the point that they may change or remove the policy, which can happen at any time.

Given the historical performance, the 10% distribution would not have been covered. Again, with the fund’s transition, it is even harder to gauge what the future could bring, but 10% is fairly lofty. In this way, this makes the distribution policy another way that the fund is self-liquidating over time beyond just the quarterly redemptions.

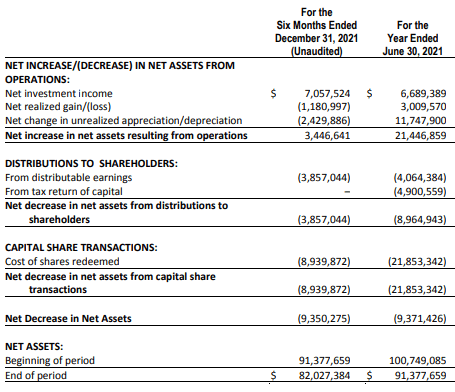

When taking a look at the fund’s earnings, they actually provide a substantial amount of net investment income. NII is the number of earnings that can be more regular as opposed to the more volatile capital gains. In fact, the fund’s NII coverage over the last six months was 183%.

RSF Semi-Annual Report (RiverNorth)

That was a massive increase from the prior full twelve-month fiscal year if we annualized out the latest figure. This will be something to watch going forward. Of course, the fund still shrunk in the net assets due to the redeemed shares. In this report, we can see nearly $9 million was redeemed.

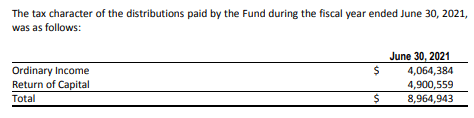

For tax purposes, 2021 saw a split between ordinary income and return of capital.

RSF Semi-Annual Report (RiverNorth)

These tax classifications can change drastically every year. Return of capital has been present in the last few years, though.

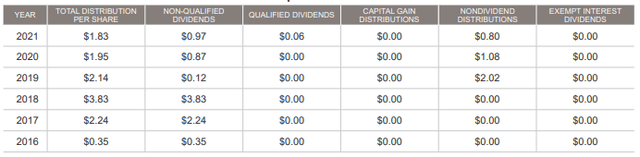

RSF Tax Info (RiverNorth)

The fairly wild swings from year to year can make it difficult to determine what type of account one would want to hold this fund in. ROC can be beneficial as a way to defer one’s taxes until the investor sells. It reduces an investor’s cost basis until it hits $0. Looking at their earnings, this wouldn’t appear to be destructive ROC either, as the NII and realized gains were enough to cover the payout.

On the other hand, the ordinary income here means that it isn’t very tax-friendly. This is often the case when underlying holdings pay interest as it is going to generally be taxed at your highest amount. Only a small portion in 2021 was considered qualified, with the prior year showing 0% qualified.

Conclusion

RSF definitely isn’t for everyone. The small size and high expense ratio are certainly deterrents. The unique positioning and structure can make it even more complicated for investors. The higher expense ratio means they have to be able to perform consistently – which, to their credit, seems they have been able to manage okay so far. At least in 2021, and then relatively speaking in 2022 with the rest of the market down meaningfully. However, we don’t have a lot of history since the fund began its transition in 2020 and seems to still be evolving as opportunities arise.

This fund might be fine to hold, but I wouldn’t personally consider adding this to my portfolio at this time. I think that a deep 10%+ discount again could get me interested. Given the performance of the overall market and the volatility we have been experiencing, it is a bit interesting that RSF isn’t presenting a larger discount for shareholders. This fund has truly bucked that trend of widening discounts in the CEF space for 2022, moving in the opposite way instead.